What Is Customer Lifetime Value and How to Calculate It

- briannahafeman54

- Dec 2, 2025

- 17 min read

Updated: Dec 15, 2025

At its core, Customer Lifetime Value (CLV) is the total predicted profit a business expects to make from a single customer over the entire time they're with you. It’s a shift in perspective—moving away from the single transaction and zooming out to see the long-term worth of that relationship.

It answers the one question that really matters for sustainable growth: how much is this customer relationship truly worth over time?

What Is Customer Lifetime Value Explained Simply

Let's imagine you run a local coffee shop. One person pops in, buys a single £3 latte, and you never see them again. Their value to your business is exactly £3.

Now, think about another customer. She also buys a £3 latte, but she does it every weekday on her way to work. Over five years, she'll have spent over £3,900. The difference between these two customers is massive, and CLV is the metric that brings this crucial distinction into focus.

It's a forward-looking calculation, an estimate of the total net profit you can reasonably expect from someone throughout their entire journey with your brand. This simple but powerful idea looks beyond this month's sales figures to reveal the true health and resilience of your business model.

Understanding your CLV is what helps you make smarter, more strategic decisions about how much you should be spending to acquire new customers and, just as importantly, how much effort you should put into keeping the ones you already have.

The Core Components of CLV

At its heart, CLV is built on a few fundamental ideas. Instead of viewing customers as a series of isolated purchases, it encourages you to see them as long-term assets.

This perspective is absolutely vital because it almost always costs significantly more to attract a new customer than it does to keep an existing one happy and coming back for more. For a more comprehensive look at the core concept, you can delve deeper into Customer Lifetime Value and its foundational principles.

To really get your head around what customer lifetime value is, you need to be familiar with the key ingredients that feed into the calculation.

Before we jump into the formulas, let's break down the concepts that power them. This quick table summarises the essential building blocks of CLV, giving you a solid foundation.

Key CLV Concepts at a Glance

Concept | What It Measures | Why It's Important |

|---|---|---|

Average Purchase Value | The average amount a customer spends in one transaction. | Tells you how much each purchase is worth. |

Purchase Frequency | How often a customer buys from you in a given period. | Shows customer loyalty and habit. |

Customer Lifespan | The total time a customer actively does business with you. | Dictates the duration over which you can earn revenue. |

These three pillars—how much they spend, how often they spend, and for how long they stick around—are the engine behind any meaningful CLV calculation.

A Practical View on Calculation

These components come together to form a clearer picture of your future revenue. The most straightforward formula looks something like this: CLV = (Average Revenue Per Customer × Customer Lifespan) − Total Costs to Serve.

This approach works especially well for businesses with reliable historical data and a fairly consistent pricing model, as it gives you a clear, profit-focused result.

By focusing on CLV, you are investing in a strategy of sustainable growth. It forces you to prioritise customer satisfaction and loyalty, which are the cornerstones of any resilient business. It’s not just about numbers; it’s about building relationships that last.

Why Customer Lifetime Value Matters for Your Business

Let’s be honest, it’s easy to get fixated on the next sale, the next sign-up, the next quarterly target. But focusing only on short-term wins can be a bit like eating junk food – it feels good in the moment, but it’s not a sustainable strategy for long-term health. This is where understanding Customer Lifetime Value (CLV) completely changes the game.

CLV acts as a strategic compass for your business, shifting your entire focus from fleeting transactions to fostering lasting, profitable relationships. It forces you to think beyond the immediate revenue hit and consider the entire journey a customer has with your brand. Once you start tracking it, you’ll find it informs just about every important decision you make.

Informing Your Marketing Budget

One of the first places CLV makes its presence felt is in your marketing spend. It cuts through the guesswork and answers a critical question that keeps founders up at night: how much can we really afford to spend to get a new customer?

This is where the crucial relationship between CLV and Customer Acquisition Cost (CAC) comes into play. If you know the average customer will generate £1,000 in profit over their lifetime, you suddenly have a very clear ceiling for your acquisition costs. Spending £500 to acquire that customer? You’ve got a healthy, sustainable model. Spending £1,200? You’re literally paying to lose money with every new sign-up, even if your top-line revenue looks impressive.

By comparing the long-term value customers deliver to the cost of acquiring them, CLV provides a crucial measure of future profits. This allows founders and investors alike to assess a business’s long-run health and sustainability.

This simple insight is incredibly powerful. It empowers you to set realistic budgets for your ad campaigns, content marketing, and sales teams. You stop chasing growth at any cost and start investing in the channels that bring in the right kind of profitable, long-term customers.

Identifying Your Most Valuable Customers

It’s a simple truth in business: not all customers are created equal. Some will buy once and disappear, while others will become the bedrock of your revenue. CLV is the tool that allows you to tell the difference.

It lets you segment your customer base and pinpoint the high-value individuals and groups who are the real drivers of your profitability. Research consistently shows that a small, loyal cohort of customers often punches way above its weight, generating a huge slice of your total revenue.

Once you know who these people are, you can double down on nurturing those relationships. These are the customers who are most likely to:

Respond to Upsell Opportunities: They already trust you, making them far more open to buying premium products or add-on services.

Become Brand Advocates: A happy, long-term customer is your best marketing asset. They're the ones who will rave about you to their friends and colleagues.

Provide Valuable Feedback: Because they’re invested in your success, their feedback is often the most insightful and constructive, helping you improve your offering for everyone.

By focusing on these key segments, you ensure your retention efforts are aimed where they’ll deliver the biggest financial impact.

A Barometer for Business Health

Beyond budgets and customer segments, CLV acts as a vital health check for your entire business. Think of it as an early warning system. A rising CLV is a fantastic sign – it tells you that customers are happy, they’re sticking around, and they’re continuing to find value in what you offer.

On the flip side, a declining CLV can be the first red flag that something is wrong under the surface. It offers a window into several key performance areas:

Customer Satisfaction: If CLV is consistently low or trending downwards, it could be a sign of issues with your product quality, customer support, or the overall user experience. One recent report found that 40% of customers stopped doing business with a brand due to inconsistent quality.

Brand Loyalty: A strong CLV is a direct reflection of loyalty. It shows that customers are actively choosing you over your competitors, which is a powerful testament to the strength of your brand.

Product-Market Fit: When customers not only stay but continue to spend over time, it’s one of the strongest signals you can get that your product is genuinely solving their problems and meeting their needs.

Ultimately, tracking CLV helps you build a more resilient and sustainable business. It moves you away from volatile, transaction-based thinking and toward a stable, relationship-driven strategy that fuels predictable, long-term growth.

How To Calculate Customer Lifetime Value Step By Step

Now that we’re clear on why CLV is a vital compass for any growing business, it’s time to get our hands dirty with the numbers. Calculating customer lifetime value isn’t nearly as intimidating as it sounds, and you’ve got a few different models to choose from, each offering a different balance of simplicity and precision. We’ll start with the basics and work our way up to the more powerful, forward-looking methods.

The most important thing? Just start somewhere. Even a back-of-the-envelope calculation is infinitely more useful than flying blind. It gives you a baseline you can build on and improve over time.

Starting With Historic CLV

The most straightforward place to begin is by looking in the rearview mirror. The Historic CLV model calculates value based on the profit a customer has already brought in. It’s not trying to guess the future; it simply tallies up past wins.

To get this number, you just need to add up all the transactions from a single customer and apply your margin.

Formula: Historic CLV = (Transaction 1 + Transaction 2 + ... + Transaction N) x Average Gross Margin

Let’s imagine a customer made three purchases with you, spending £50, £75, and £60. If your average gross margin is 40%, the maths looks like this: (£50 + £75 + £60) x 0.40 = £185 x 0.40 = £74.

The beauty of this method is its simplicity—it uses data you definitely already have. Its biggest flaw, however, is that it treats the customer's journey as if it's already over, making it less useful for nurturing the relationships you still have.

Using The Traditional CLV Formula

A much more common and slightly more sophisticated method is the Traditional CLV formula. This model uses business-wide averages to create a simple predictive value for a typical customer. It’s a fantastic middle ground for businesses that want a forward-looking metric without diving into complex statistical modelling.

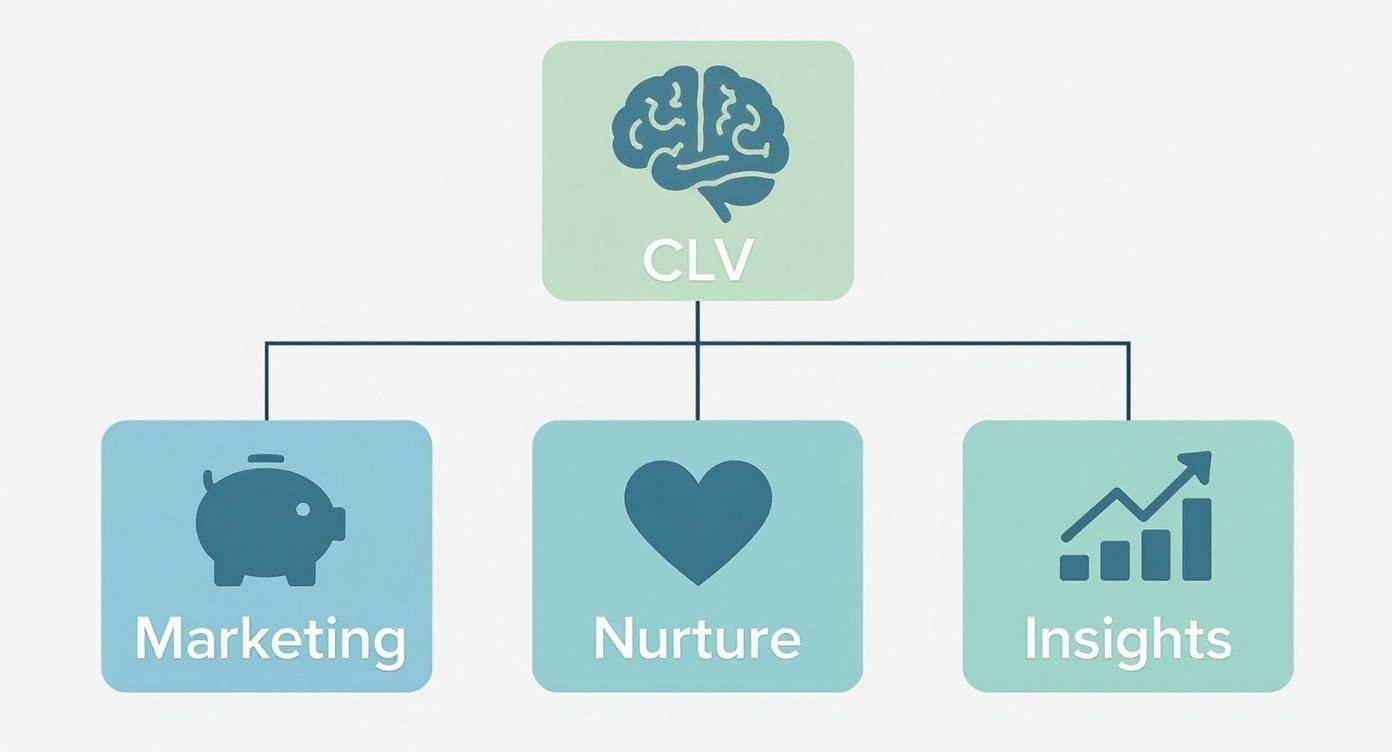

This is where CLV starts to become a central hub for guiding key business functions like marketing, customer support, and strategic planning.

As you can see, a clear understanding of CLV directly fuels smarter decisions across the board, turning what seems like a simple metric into a powerful engine for growth. The numbers you need for this calculation are often part of your core marketing KPIs anyway, which are essential for tracking performance.

Key Takeaway: The Traditional CLV model gives you a snapshot of an 'average' customer's potential worth. It's not perfectly precise for individuals, but it's incredibly useful for making broad strategic decisions about your marketing budget and where to focus your resources.

To calculate it, you’ll need to pull three key pieces of information:

Average Purchase Value (APV): Total Revenue / Number of Orders

Average Purchase Frequency Rate (APFR): Number of Purchases / Number of Customers

Average Customer Lifespan (ACL): Sum of Customer Lifespans / Number of Customers

First, you figure out the Customer Value (CV) by multiplying the first two metrics: CV = APV x APFR. From there, you can find the final CLV: CLV = CV x ACL.

Advancing To Predictive CLV

While the historical and traditional models are great starting points, they have their limits. They tend to assume customer behaviour stays the same and treat all customers as one big average. This is where Predictive CLV comes in, offering a much sharper, more dynamic view of future value.

Predictive models use transaction history and behavioural patterns—often with the help of machine learning—to forecast what a customer is likely to spend in the future. The calculations can get pretty complex, but they paint the most accurate picture of customer lifetime value.

They analyse factors like:

How recently a customer made a purchase

How frequently they buy

The monetary value of their purchases (this is often called RFM analysis)

Their behaviour on your website or app

Demographic and psychographic data

Because these models are tailored to individual or segment behaviour, they can spot your future VIPs long before their spending habits make it obvious. For businesses with large customer bases and enough data, investing in predictive analytics can be a massive competitive advantage. It opens the door to highly personalised marketing, proactive churn prevention, and smarter customer acquisition.

To go even deeper on the maths behind these methods, check out this comprehensive guide on How To Calculate Customer LTV.

To help you decide which approach is right for your business, here’s a quick comparison of the three methods we've covered.

Comparing CLV Calculation Methods

Calculation Method | What It Measures | Best For | Complexity |

|---|---|---|---|

Historic | Actual profit generated by a customer to date. | Quick, simple analysis using readily available past transaction data. | Low |

Traditional | The average projected value of a typical customer. | Businesses needing a simple, forward-looking metric for strategic planning. | Medium |

Predictive | Forecasted value for individual customers or segments. | Data-rich businesses seeking high accuracy for personalisation and retention. | High |

Each model has its place. The key is to pick the one that aligns with your current data capabilities and strategic needs, knowing you can always graduate to a more advanced method as your business evolves.

Understanding the CLV to CAC Ratio

Getting a handle on your CLV is a massive step forward, but the metric doesn't live on an island. Its true power is unlocked when you pair it with its other half: Customer Acquisition Cost (CAC). This is everything you spend to land a new customer—from marketing salaries and ad spend right through to sales commissions.

The CLV to CAC ratio is the ultimate health check for your business model. It cuts through the noise of simple revenue figures to answer the most critical question for any growing company: are the customers we're bringing in worth more than what we're spending to get them? This single number tells you almost everything you need to know about the profitability and efficiency of your entire go-to-market strategy.

Think of it this way: your CLV is the total fuel a car's tank can hold, while your CAC is the cost to fill it up. Knowing your tank size is one thing, but knowing whether the fuel costs more than the distance you can travel is what really matters. This ratio tells you if you've got a viable journey ahead or if you're about to run out of road.

What Is a Good CLV to CAC Ratio?

Once you have your CLV and CAC figures, the calculation itself is dead simple. You just divide your CLV by your CAC. For example, if your average CLV is £900 and it costs you £300 to acquire each customer, your ratio is a healthy 3:1.

But what do these numbers actually mean in the real world? While the ideal ratio can vary by industry, a few general benchmarks will help you see where you stand.

Below 1:1: This is a five-alarm fire. You're spending more to get a customer than you ever make back from them. Every new customer you sign is actively losing you money.

1:1: You're just about treading water. Every pound you put into acquisition eventually comes back, but there's nothing left over for profit, operations, or reinvesting in growth.

3:1: This is widely seen as the gold standard. It signals a healthy, efficient, and scalable business. For every pound you invest in acquisition, you get three back over time, leaving a solid margin for profit and reinvestment.

5:1 or Higher: While this looks amazing on the surface, an extremely high ratio can sometimes mean you're underinvesting in growth. You might be leaving money on the table by not spending enough to reach more valuable customers.

A good rule of thumb is that a CLV-to-CAC ratio of three or higher is attractive and indicates a scalable business where you’ll be able to cover your marketing costs, overhead, and still make a profit. This balance is critical for long-term financial health.

This ratio gives you a clear, quantifiable measure of your marketing's return on investment and the fundamental viability of your business.

Using the Ratio to Make Smarter Decisions

The real magic of the CLV to CAC ratio is how it guides your strategy. It’s not just a number for your board deck; it’s a tool for actively shaping your company’s future.

For instance, if your ratio is a worrying 1.5:1, you know you have two main levers to pull. You can either focus on driving up your CLV (which we'll dig into next) or work on pushing your CAC down. That could mean optimising ad spend, improving conversion rates, or leaning into more cost-effective channels like SEO and referrals.

On the other hand, if you're sitting on a strong 4:1 ratio, that’s your green light to get more aggressive. You know each new customer is highly profitable, so you can confidently scale up campaigns, explore new channels, and invest more in grabbing market share, all with the knowledge that the underlying economics are solid.

By keeping a constant eye on this crucial metric, you can fine-tune your growth engine, sharpen your customer targeting, and build a business that doesn't just grow, but grows profitably and sustainably.

Proven Strategies to Increase Customer Lifetime Value

Knowing how to calculate your CLV is one thing. Actually doing something to increase it? That’s where the real growth happens.

Boosting CLV isn't about finding a single magic bullet. It's about systematically improving the entire customer journey, bit by bit, turning one-time buyers into loyal advocates who stick around for the long haul.

These are tried-and-tested ways to nurture customer relationships and maximise their long-term value. Nailing these areas will help you build a far more resilient and profitable business.

Create a Flawless Onboarding Experience

First impressions are everything. The first few interactions a customer has with your brand can make or break the entire relationship. A clunky, confusing, or underwhelming start can kill potential CLV before it even has a chance to grow.

A great onboarding experience does more than just show someone how your product works. It instantly validates their decision to buy from you, demonstrates value right out of the gate, and sets a positive tone for everything that follows.

To get this right, you need to:

Provide Clear Guidance: Use a smart mix of welcome emails, in-app tours, and easy-to-find help docs to walk new users through those first critical steps.

Set and Meet Expectations: Be upfront about what they can expect from you and what they need to do to find success with your product.

Celebrate Early Wins: Help customers get to their first "aha!" moment as quickly as you possibly can. This builds momentum and reinforces why they chose you in the first place.

A seamless start removes friction and makes customers feel confident and supported, which is the absolute bedrock of long-term loyalty.

Implement a Smart Loyalty Programme

Rewarding customers for coming back is a direct and powerful way to increase how often they buy and how long they stay with you. A well-designed loyalty programme makes customers feel seen and gives them a real reason to choose you over a competitor next time.

But modern loyalty programmes go way beyond simple points-for-pounds systems. The best ones build a sense of community and exclusivity that deepens the emotional connection to your brand.

By making customers feel valued, you're not just encouraging another purchase; you're building a relationship. Loyalty programmes are a powerful tool for turning transactional customers into a community of brand advocates who stick around for the long haul.

Think about weaving in elements like:

Tiered Rewards: Offer increasingly valuable perks as customers spend more, giving them a clear incentive to level up.

Exclusive Access: Give members early access to new products, special content, or members-only sales.

Non-Monetary Benefits: Think outside the box with experiential rewards like invites to special events or personalised consultations.

These programmes directly tackle the core components of CLV, encouraging customers to buy more frequently and stick around for longer.

Leverage Email Marketing for Upselling and Cross-selling

Email is still one of the most effective channels you have for nurturing existing customer relationships. It lets you speak directly to your audience, deliver value, and present relevant offers that can seriously increase their average order value.

The trick is to move beyond generic, one-size-fits-all promotional blasts. Smart email marketing uses customer data to send targeted, relevant, and timely messages that show you actually understand their needs. If you want to dig deeper, check out our guide on the power of personalisation in growth marketing.

Take a fictional UK-based coffee subscription, 'The Daily Grind', for example. If their average customer spends £20 per order, buys 6 times a year, and stays for 3 years, their Historic CLV is £360 in revenue. But if we factor in a 25% profit margin, the Traditional CLV becomes a much more realistic £90 in actual profit. This really highlights how crucial every single retained customer is.

Actively Seek and Implement Customer Feedback

Your customers are your single greatest source of truth for improving your business. Actively listening to their feedback—and, more importantly, acting on it—shows them you value their opinion and are committed to making things better for them.

This creates a powerful feedback loop. Customers feel heard, your product improves, and satisfaction goes up, which leads directly to higher retention and a better CLV.

Here’s how to put this into practice:

Systematically Collect Feedback: Use a mix of tools like NPS surveys, in-app feedback forms, and even just direct conversations to gather insights at different stages of their journey.

Analyse for Trends: Don't get lost in individual comments. Look for the recurring themes and prioritise the issues that have the biggest impact on the customer experience.

Close the Loop: This is the step most companies forget. When you make a change based on feedback, tell your customers about it! This simple act proves their voice matters and reinforces their decision to stick with you.

When you make your customers feel like partners in your brand's evolution, you build a kind of loyalty that money just can't buy.

Turning CLV Insights Into Sustainable Growth

Getting your head around customer lifetime value is more than just learning a new formula; it’s a fundamental shift in how you think about your business. It’s the move away from chasing short-term sales targets towards a mindset obsessed with building profitable, long-term relationships. That perspective is the very definition of a resilient, sustainable business.

Once you start focusing on the entire customer journey, you almost automatically begin making smarter decisions. Every choice—from marketing campaigns and product updates to the way you handle customer service—gets filtered through the lens of long-term value. This simple change turns CLV from a passive number on a dashboard into an active guide for your company’s direction.

Suddenly, the CLV to CAC ratio becomes your most important health check, telling you in an instant whether your growth engine is viable. It’s the difference between building a profitable company and just spinning your wheels.

Your Next Steps With CLV

Look, the goal isn't to nail a perfect, PhD-level calculation on day one. The real power comes from just starting the process and setting a baseline you can build on.

Here’s how you can start turning these ideas into action:

Start Simple: First things first, use the historic CLV formula to get your initial benchmark. Don't let perfect be the enemy of good. You just need a starting point.

Identify Top Segments: Dig into the numbers and figure out which customer groups have the highest CLV. This is where you should be focusing your retention and loyalty efforts for the biggest impact.

Integrate CLV into Decision-Making: Weave CLV into your strategic conversations. For every new initiative, ask the simple question: "How will this affect the long-term value of our customers?"

Ultimately, CLV is more than a calculation—it's your north star metric. It ensures that as you grow, you are building a company with a strong foundation, loyal customers, and predictable profitability.

By adopting this customer-centric view, you’ll find that many of these principles align perfectly with effective scaling startup strategies for sustainable growth, creating a powerful engine for your business.

CLV Questions Answered

Diving into customer lifetime value can spark a few practical questions. Let's tackle some of the most common queries that pop up when businesses start weaving CLV into their growth plans.

What Is a Good Customer Lifetime Value?

This is a bit like asking "how long is a piece of string?" There's no magic number that works for everyone. A "good" CLV for a high-end software company selling enterprise deals will be worlds apart from a great CLV for a local coffee shop.

The real insight comes from the CLV to CAC ratio. This is the metric that truly matters. It stacks up what a customer is worth to you over their lifetime against what it cost you to get them in the door. For most businesses, a 3:1 ratio is the gold standard. It’s a clear signal of a healthy, sustainable model: for every £1 you spend acquiring a customer, you get £3 back.

How Often Should I Calculate CLV?

For the majority of businesses, running the numbers on a quarterly or semi-annual basis hits the sweet spot. It's frequent enough to catch emerging trends, see if your retention efforts are paying off, and tweak your strategy, all without getting bogged down in endless spreadsheet analysis.

That said, if your company is in a hyper-growth phase or has very short sales cycles, you might want to pull these reports more often. A monthly calculation can give you the agility to react much faster to shifts in customer behaviour.

What Are the Most Common Mistakes When Calculating CLV?

It's easy to get tripped up when you're starting out. A few common pitfalls can seriously skew your CLV calculations, leading you to draw the wrong conclusions. Watch out for these.

Here are the top mistakes we see time and time again:

Using Revenue Instead of Profit: This is the big one. Calculating CLV with top-line revenue makes your numbers look great but completely masks the actual profitability of a customer. Always, always use gross margin to get a true picture.

Ignoring Customer Segmentation: Lumping everyone together into one giant average is a recipe for misleading data. This approach hides the crucial differences between your die-hard fans and your one-and-done buyers, making it impossible to spot your real VIPs.

Relying Only on Historical Data: Looking back is useful, but it’s not a crystal ball. Markets change, and customer habits evolve. Basing your entire strategy on past behaviour without layering in any forward-looking, predictive elements can leave you flat-footed.

Key Takeaway: Getting CLV right means sidestepping these common errors. To make your numbers truly actionable, you need to focus on profit, segment your customers, and use a smart mix of historical and predictive data to guide your decisions.

Ready to turn CLV insights into a powerful, sustainable growth engine for your brand? At Ryesing Limited, we build and execute data-driven marketing programs that measurably boost acquisition, activation, and retention. Discover how our strategic expertise can help you scale.